mississippi property tax calculator

In Mississippi Property Tax Revenues are Used to Fund. How To Calculate Ms Real Estate Taxes.

North Central Illinois Economic Development Corporation Property Taxes

Registration fees are.

. This is only an estimate based on the current tax rate and the approximate value of the property. The annual appreciation is an optional field where you can enter 0 if you do not wish to include it in the MS property tax calculator. Estimate Property Tax Our Mississippi Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Mississippi and across the entire United States.

Accordingly you would have a tax bill of 1500 if your homestead exemption is and has been applied to 15000 in assessed value and 100 millage rate. Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators. L 1055 Public Schools in 163 School Districts educating 493540 students source.

Estimated Taxes. Use of this information acknowledges my understanding of these conditions. The Mississippi Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Mississippi State Income Tax Rates and Thresholds in 2022.

Select the tax district to calculate the Mill Rate. Mississippi Property Tax. Taxes on property in Mississippi are among the lowest in the nation.

The appraised value of the property. Counties in Mississippi collect an average of 052 of a propertys assesed fair market value as. Penalty or interest of 125 monthly 15 annually on the outstanding balance of tax arrears is added to your account on the first business day of.

Please call the office or look up your property record for an official amount due. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the time of registration. Calculate how much your real real estate tax bill will be with the higher value and any tax exemptions you qualify for.

If Mississippi County property tax rates have been too high for your budget causing delinquent property. Ad Look Up Any Address in Mississippi for a Records Report. The average effective property tax rate taxes per year as a percentage of home value in the Magnolia State is just 079.

Mississippi salary tax calculator for the tax year 202122. This is strictly an estimate on annual property taxes and is based on the values that you enter. Find Details on Mississippi Properties Fast.

052 of home value Tax amount varies by county The median property tax in Mississippi is 50800 per year for a home worth the median value of 9800000. Desoto County Assessor DeSoto County Tax Assessor. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

Compare your rate to the Mississippi and US. Please fill out the form below and click on the calculate button. Our calculator has been specially developed.

Carefully calculate your actual property tax using any exemptions that you are allowed to use. Learn About Owners Year Built More. Mississippi Property Tax Calculator Property Tax Calculator How High Are Property Taxes in Your State.

A Class II property has a true value of 75000 and is in a taxing district in which the tax levy is 11772 mills. How To Calculate the Ad Valorem Tax on a Specific Parcel of Property Lets say a. Estimate Your Property Taxes.

Tax Foundation Property Tax Calculator Are There Any States with No Property Tax in 2021. This is an estimate only. The combined rate used in this calculator 7 is the result of the mississippi state rate 7.

You are able to use our Mississippi State Tax Calculator to calculate your total tax costs in the tax year 202122. Real Property Tax Estimate. We value your.

If Mississippi property tax rates have been too high for you resulting in delinquent property tax payments. NO Homestead Exemption 10 Assessment. Mississippi Property Tax Rates One mill is equal to 1 of tax for every 1000 in assessed value.

See Results in Minutes. The final tax bills are usually sent out in June each year and have two installments due the second last business day of July and September. For more details about taxes in Desoto County or to compare property tax rates across Mississippi see the Desoto County property tax page.

Mississippi Property Tax Calculator - SmartAsset Calculate how much youll pay in property taxes on your home given your location and assessed home value. Free vestor Guide Property Taxes Levied on Single Family Homes Up 54 Percent ATTOM Mississippi Ie Tax Reform. However because of the relatively low home values in Mississippi the total annual property tax payment in Mississippi is just.

Actual tax amounts may varyThe data provided is for informational purposes only. Pike County - Property Tax Estimate Calculator County North Pike SD County South Pike SD County McComb SD Osyka Magnolia Summit McComb McComb SD McComb North Pike SD McComb. Mississippi Salary Tax Calculator for the Tax Year 202122.

Our Panola County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Mississippi and across the entire United States. NO Homestead Exemption 15 Assessment. Mississippi Property Tax Calculator to calculate the property tax for your home or investment asset.

The 39653 meadville mississippi general sales tax rate is 7. Realistic real estate value appreciation will not increase your annual bill sufficiently to make a protest worthwhile. Please keep your final tax bill for income tax purposes.

Details of the personal income tax rates used in the 2022 Mississippi State Calculator are published below the. Details u0026 Evaluation Tax. Then question if the size of the increase justifies the work it requires to challenge the assessment.

This is only an estimate based on the current tax rate and the approximate value of the property. Property tax is calculated based on your home value and the property tax rate. The tax assessor has a Tax Calculator to help you estimate the cost of your property taxes.

Real Property Tax Estimate. 365 Losher Street Suite 100. Calculate the tax bill.

This is only an estimate of your tax due. 11772 Mills 11772 True Value- 75000 Class II Rao- x 15 Assessed Value- 11250 Mill Rate- x 11772 Tax Bill- 132435. Motor Vehicle Ad Valorem Taxes.

Motor vehicle ad valorem tax is based on the assessed value of the vehicle multiplied by the millage rate set by the local county government. How can we improve this page.

Hennepin County Mn Property Tax Calculator Smartasset

What Is A Homestead Exemption And How Does It Work Lendingtree

How Do State And Local Sales Taxes Work Tax Policy Center

Thinking About Moving These States Have The Lowest Property Taxes

Excel Formula Tax Rate Calculation With Fixed Base Exceljet

Mississippi Property Tax H R Block

Mississippi Property Tax Calculator Smartasset

Property Taxes Calculating State Differences How To Pay

Mississippi Sales Tax Small Business Guide Truic

States With Highest And Lowest Sales Tax Rates

Mississippi Property Tax Calculator Smartasset

Mississippi Property Tax Calculator Smartasset

Mississippi Income Tax Calculator Smartasset

Historical Tennessee Tax Policy Information Ballotpedia

Understanding Mississippi Property Taxes Mississippi State University Extension Service

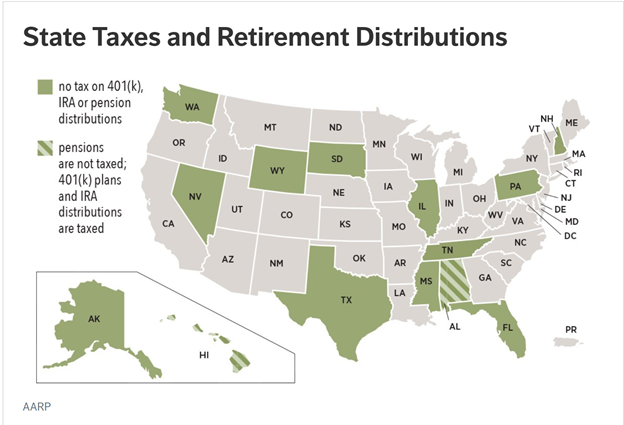

Moneywise Kansas 3rd Worst State For Taxing Retirees Kansas Policy Institute

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)